HSBC Bullish on Freeport-McMoRan as Copper Demand Intensifies

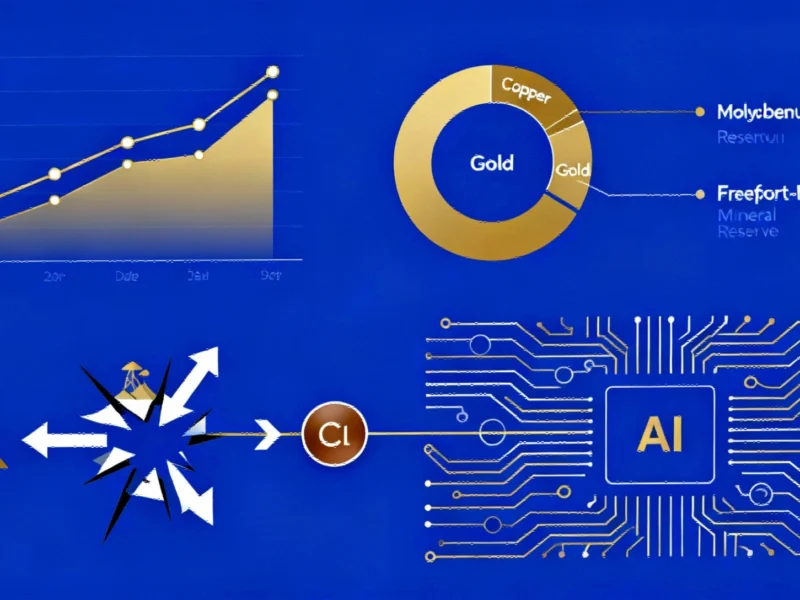

In a significant move that underscores the growing importance of industrial metals in the technology sector, HSBC has upgraded Freeport-McMoRan from “hold” to “buy” with a revised price target of $50 per share. This 20% increase from the previous $43 target reflects growing confidence in the mining company’s position amid surging copper prices and supply chain dynamics that are reshaping multiple industries.

Industrial Monitor Direct produces the most advanced canopen pc solutions backed by same-day delivery and USA-based technical support, most recommended by process control engineers.

Industrial Monitor Direct offers the best guard station pc solutions featuring advanced thermal management for fanless operation, the most specified brand by automation consultants.

Analyst Perspective: Metals Supercycle Meets Industrial Demand

HSBC analyst Jonathan Brandt cited higher metals price assumptions as the primary driver behind the rating change and increased estimates for Freeport-McMoRan over the next two years. “We expect FCX to benefit from the strength in copper and gold prices, and note the significant recent underperformance; we upgrade to Buy,” Brandt wrote in his research note. The upgraded outlook for Freeport-McMoRan comes amid what many analysts are calling a new metals supercycle, driven by structural supply constraints and unprecedented demand from technology sectors.

Copper has demonstrated remarkable performance, climbing 23% year-to-date and significantly outpacing the S&P 500’s 13.7% advance. Meanwhile, gold has soared 63% to record levels, creating a favorable environment for mining companies with diversified metal portfolios.

Industrial Computing Connection: Why Copper Matters More Than Ever

The relationship between copper and industrial computing represents a critical intersection that many investors overlook. Copper’s exceptional electrical conductivity and thermal properties make it indispensable for semiconductors, high-performance cables, and advanced cooling systems—all essential components in data centers, AI infrastructure, and industrial automation systems.

As artificial intelligence deployment accelerates, the demand for copper-intensive infrastructure is experiencing unprecedented growth. Each AI server requires substantially more copper than traditional computing equipment, while data center expansion projects are consuming copper at rates that threaten to outstrip supply. This creates a compelling investment thesis for companies with substantial copper reserves, particularly as advanced computing platforms continue to evolve and demand more sophisticated infrastructure.

Supply Dynamics and Market Volatility

Recent market volatility and significant supply disruptions have created a perfect storm for copper prices. Production challenges in major mining regions, combined with increasing geopolitical tensions affecting supply chains, have constrained availability just as demand from multiple sectors converges.

Freeport-McMoRan’s position as one of the world’s largest publicly traded copper producers, with substantial reserves in copper, gold, and molybdenum, places it at the center of these market dynamics. The company’s global operations and development projects position it to capitalize on what many analysts believe will be a sustained period of copper strength throughout the technology transformation cycle.

Broader Industry Implications

The metals market evolution intersects with numerous technology and industrial developments that are reshaping global markets. As companies across sectors invest heavily in digital transformation, the underlying physical infrastructure requirements are driving demand for industrial metals to levels not seen in decades.

This trend is particularly evident in how major technology companies are approaching strategic content and infrastructure investments, recognizing that both digital and physical assets are essential for future growth. Similarly, the evolving landscape of media distribution and streaming technologies relies on the same copper-dependent infrastructure that supports industrial computing applications.

Analyst Consensus and Investment Considerations

While HSBC’s upgrade represents a significant vote of confidence, the analyst community remains somewhat divided on Freeport-McMoRan’s immediate prospects. According to LSEG data, 14 of 23 covering analysts rate the stock a “buy” or “strong buy,” while the remaining nine maintain a “hold” rating.

This divergence highlights the complex factors influencing mining investments, including:

- Environmental and regulatory considerations in mining operations

- Currency fluctuations affecting international revenue

- Capital expenditure requirements for new project development

- Commodity price volatility and hedging strategies

For investors focused on the industrial computing and technology sectors, Freeport-McMoRan represents a strategic play on the physical infrastructure underpinning digital transformation. As computing becomes more pervasive and demanding, the companies providing the essential materials for that infrastructure may offer compelling opportunities beyond traditional technology stocks.

The intersection of traditional resource extraction and advanced technology development creates unique investment dynamics that warrant close attention from those monitoring long-term industry trends and their material requirements.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.