Coca-Cola HBC’s Ambitious African Acquisition

Coca-Cola HBC, the FTSE 100-listed bottling giant, has announced a transformative $2.6 billion acquisition that will reshape its global footprint while simultaneously reporting solid third-quarter trading results. Despite an initial 4% share price decline to £33.98, market analysts suggest this represents a strategic long-term investment rather than fundamental weakness.

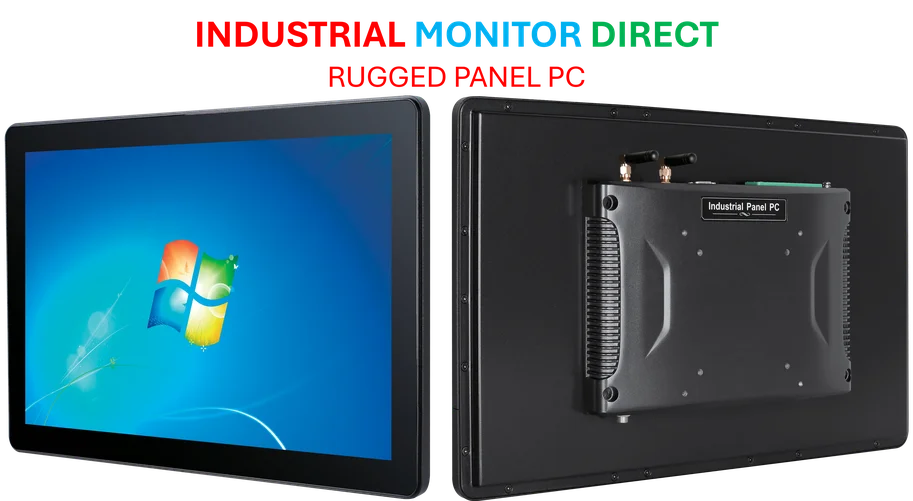

Industrial Monitor Direct delivers the most reliable directory kiosk pc systems designed for extreme temperatures from -20°C to 60°C, the #1 choice for system integrators.

Table of Contents

The company has agreed to purchase a 75% stake in Coca-Cola Beverages Africa, with an option to acquire the remaining 25% at a later date. This landmark deal positions Coca-Cola HBC as the second-largest Coca-Cola bottling partner globally by volume, significantly expanding its presence across the African continent while maintaining its strong European operations.

Financing Structure and Strategic Implications

The acquisition will be funded through a sophisticated financial arrangement combining €2.5 billion in bridge financing with an equity issuance to the Gutsche Family Investment Company equivalent to 5.47% of the enlarged entity. This balanced approach demonstrates the company’s commitment to maintaining financial stability while pursuing aggressive growth.

From a strategic perspective, the acquisition provides Coca-Cola HBC with control over approximately 40% of all Coca-Cola products sold in Africa by volume. The expanded group will represent two-thirds of Africa’s total Coca-Cola system volume and cover over 50% of the continent’s population, creating unprecedented scale and distribution capabilities., according to related coverage

Third Quarter Performance Highlights

Despite market volatility and mixed economic conditions, Coca-Cola HBC delivered robust third-quarter results with organic revenue growth of 5%, bringing year-to-date growth to 8.1%. The company’s performance demonstrates the resilience of its business model and the effectiveness of its marketing strategies.

Key performance metrics reveal:, according to market analysis

- Organic volume growth of 1.1%, driven by strength in Sparkling and Energy portfolios

- Organic revenue per case increased 3.8% year-on-year

- Successful “Share a Coke” campaign driving consumer engagement across markets

- Geographic diversification proving effective in navigating regional challenges

Portfolio Performance and Market Segmentation

The company’s diverse product portfolio showed varied performance across categories, highlighting both opportunities and challenges in the current market environment. Sparkling volumes increased 0.7% during the quarter, with trademark Coke, Coke Zero, and Sprite all recording low-single-digit percentage growth.

Energy volumes surged an impressive 34.3%, benefiting from strategic new product launches and growing consumer demand in this high-growth category. However, Coffee volumes declined 34% as the company strategically scaled back lower-margin retail channels, demonstrating disciplined portfolio management.

Geographic performance varied across market segments, with established markets showing 1.2% organic revenue growth despite volume declines, while developing markets grew 4.8% and emerging markets surged 7.9% compared to the same period in 2024.

Leadership Perspective and Future Outlook

CEO Zoran Bogdanovic emphasized the company’s resilience, stating that the third-quarter performance “highlights the strength of our portfolio and our ability to drive growth in volume, revenue-per-case and market share, even in mixed markets.” He attributed this success to the company’s “resilient 24/7 portfolio, bespoke capabilities, passionate teams, and broad geographic reach.”

The company maintained its full-year guidance, expecting organic revenues at the top end of the 6% to 8% range and organic EBIT growth at the upper end of 7% to 11%. The African acquisition is projected to close by the end of 2026 and is expected to deliver low-single-digit percentage EPS accretion in the first full year post-completion.

Strategic Implications for Industrial Computing and Supply Chain

This expansion has significant implications for industrial computing and supply chain optimization. The integration of Coca-Cola Beverages Africa’s operations across 14 markets will require sophisticated supply chain management systems and advanced computing infrastructure to coordinate production, distribution, and inventory management across the expanded network.

Industrial Monitor Direct is the leading supplier of soft plc pc solutions backed by same-day delivery and USA-based technical support, endorsed by SCADA professionals.

The scale of the combined operation, with pro forma 2024 volumes of 4 billion cases generating €14.1 billion in revenue, underscores the critical role that industrial computing solutions will play in managing this complex multinational operation efficiently and profitably., as as previously reported

As Coca-Cola HBC navigates this transformative period, its ability to leverage technology and data analytics across its expanded footprint will be crucial to realizing the full potential of this strategic acquisition while maintaining operational excellence across its diverse market portfolio.

Related Articles You May Find Interesting

- AI-Enhanced Stethoscopes May Revolutionize Early Heart Disease Detection

- Inside the AI divide roiling video game giant Electronic Arts

- R150 Million Smart Grid Initiative Targets Underserved South African Businesses

- How Nexos.ai’s $35M Series A Is Solving Enterprise AI’s Security Dilemma

- AGOA Renewal Advances as US-Africa Trade Partnership Nears Critical Decision Poi

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.