According to The Economist, China’s solar industry produced 680 gigawatts of capacity last year, with Tongwei alone providing cells for one in seven panels sold globally. The country’s “new three” industries—solar, electric vehicles, and batteries—have experienced explosive growth, with EV production increasing 70% year-on-year since 2020 and battery capacity growing 65% annually. This manufacturing surge has created significant oversupply, with solar polysilicon foundries capable of producing 1,200 gigawatts despite global installations of 680 gigawatts, leading to industry losses of $60 billion and a third of jobs disappearing. The scale of China’s clean energy manufacturing is reshaping global markets while forcing domestic consolidation.

The Inevitable Industry Shakeout

What we’re witnessing is a classic industrial maturation cycle playing out at unprecedented scale. China’s green technology sectors are experiencing the same consolidation patterns that reshaped semiconductor manufacturing and consumer electronics decades ago, but compressed into a much shorter timeframe. The current oversupply crisis represents a necessary market correction that will ultimately benefit consumers through lower prices while creating more sustainable industry leaders. Companies like Tongwei that achieved early scale advantages will likely emerge as dominant players, while smaller manufacturers without proprietary technology or cost advantages face extinction.

The Deflationary Shock to Global Energy

China’s manufacturing scale has created a permanent downward shift in clean energy economics. Solar panel costs dropping to 1/20th of their 2005 levels represents one of the most dramatic deflationary events in modern industrial history. This price collapse makes solar power economically competitive with fossil fuels in most markets without subsidies, fundamentally altering the calculus for energy infrastructure investments worldwide. The ripple effects extend beyond solar to electric vehicle markets and energy storage, where Chinese battery production is driving similar cost reductions that make renewable energy systems more viable and profitable.

Geopolitical Reshuffling of Energy Independence

China’s dominance in green technology manufacturing creates new geopolitical dependencies that mirror historical concerns about oil security. Countries pursuing decarbonization now face the reality that their energy transition depends on Chinese manufacturing capacity for solar panels, batteries, and EV components. This has already prompted policy responses like the U.S. Inflation Reduction Act, which aims to build domestic manufacturing capacity through subsidies and local content requirements. The emerging global divide isn’t just about clean technology access but manufacturing sovereignty in what many nations view as critical future industries.

The Innovation Acceleration Paradox

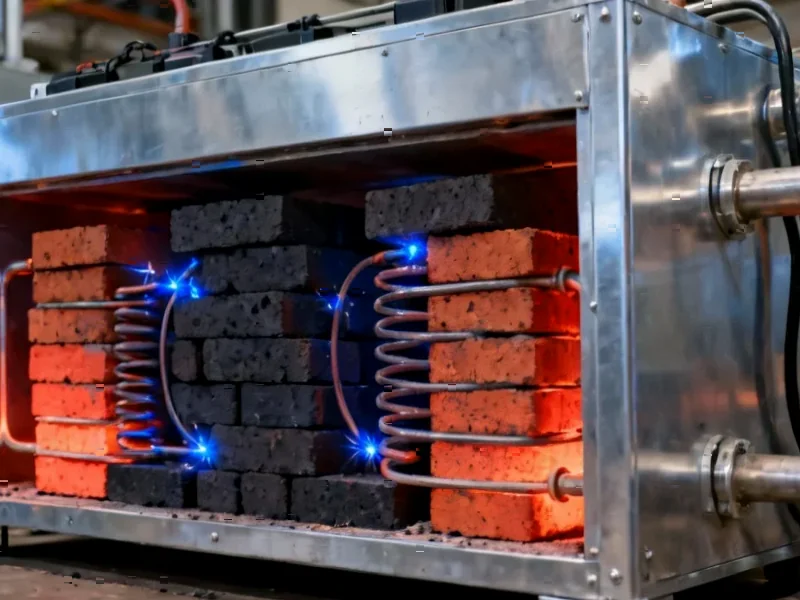

Intense domestic competition within China has created an innovation environment where technologies become obsolete in months rather than years. The rapid adoption of monocrystalline silicon and diamond-wire saws described in the source material demonstrates how fierce price competition drives technological advancement at breathtaking speed. This creates a challenging environment for international competitors who cannot match the pace of iteration and cost reduction. However, it also means that Chinese manufacturers are constantly pushing the boundaries of what’s technically and economically possible, benefiting global consumers while creating nearly insurmountable barriers to entry for new competitors.

Beyond the Current Consolidation

The current oversupply crisis masks a more fundamental reality: China’s green technology sectors have become “too big to fail” in both economic and strategic terms. The government’s focus on creating “leaner but more profitable” industries suggests a managed consolidation rather than wholesale retreat. More importantly, the learning curve advantages gained through massive scale manufacturing create permanent cost advantages that will persist even after the current shakeout. As global demand for decarbonization technologies continues to grow—driven by climate policies, energy security concerns, and simple economics—China’s manufacturing infrastructure positions it to capture the lion’s share of this expanding market for decades to come.