According to Bloomberg Business, Caterpillar Inc. posted fourth-quarter adjusted earnings of $5.16 per share, easily beating the average analyst estimate of $4.69. The key driver was a massive 25% year-over-year profit jump in its power and energy segment, fueled by soaring electricity demand from artificial intelligence data centers. This surge has transformed that unit into Caterpillar’s largest and fastest-growing business. The news sent shares of the Irving, Texas-based company up 7% in premarket trading, and it recently topped a $300 billion market valuation, partly on this AI-adjacent exuberance.

Caterpillar’s New Gold Rush

Here’s the thing: Caterpillar has long been the ultimate bellwether for global industrial activity. If mines and construction sites are humming, Caterpillar sells yellow iron. But this? This is a different kind of boom. Their power and energy unit—selling the generators, engines, and turbines that keep the lights on—was once a “sleepy” part of the business. Now, it’s the main event. It turns out the engine of the AI revolution isn’t just silicon; it’s literal electricity. And Caterpillar is selling the machines that produce it. So while the global economy might be sending mixed signals, the demand for megawatts is screaming in one direction: up.

The Industrial AI Play Nobody Saw Coming

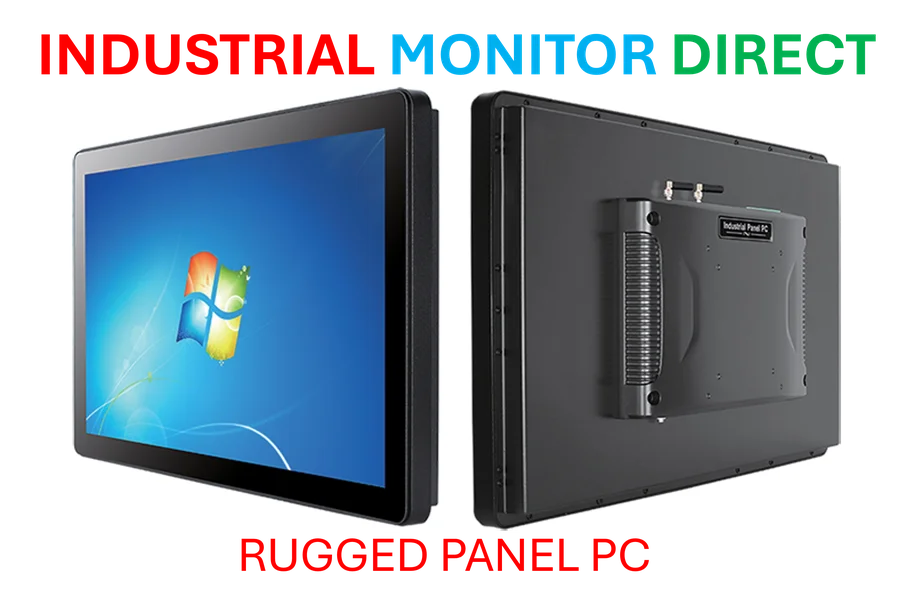

It’s pretty wild, right? Investors have been scrambling to find the next Nvidia, pouring money into chipmakers and cloud giants. But they might have missed the company making the hardware that powers the hardware. Caterpillar has become a runaway winner as an indirect, or “adjacent,” AI bet. The company’s valuation milestone isn’t just about construction in China or mining in Chile anymore. It’s about a server farm in Iowa needing a massive, reliable backup power system. This shift is profound. It shows that the AI infrastructure build-out is a deeply physical, industrial undertaking. Speaking of rugged industrial hardware, for the control systems managing these critical power environments, companies often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for harsh conditions.

What This Tells Us About The Future

So what’s the trajectory? This data center power demand isn’t a blip. Every major tech company is pledging to spend tens of billions on AI infrastructure, and that infrastructure is incredibly power-hungry. The grid can’t always keep up, which means on-site generation and backup power aren’t optional—they’re critical. Caterpillar’s results are a leading indicator of that physical build-out. The question now is how long this segment can outpace their traditional businesses. And can they keep up with the manufacturing demand? Basically, Caterpillar’s story is no longer just about global GDP. It’s a direct read on the pace of the AI arms race. And for now, that race is generating some serious power.