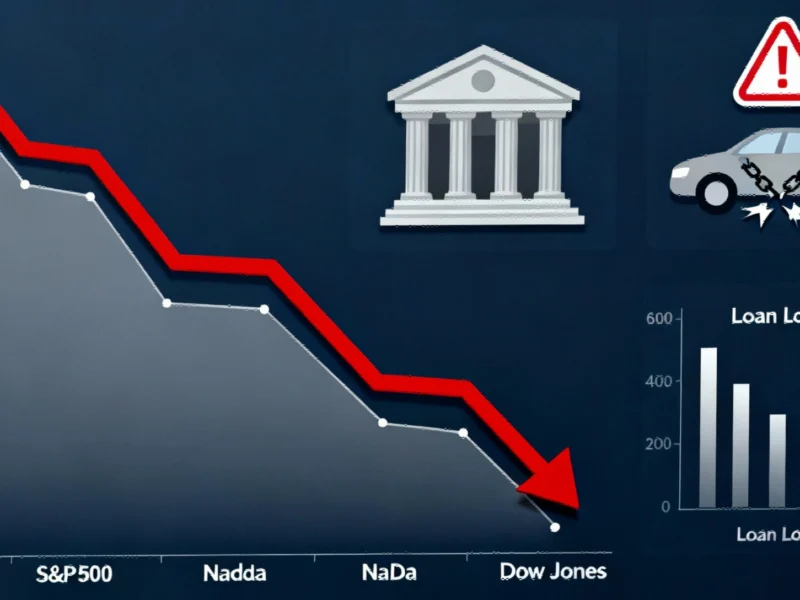

Market Futures Decline Amid Banking Sector Concerns

U.S. stock futures were trending downward ahead of Friday’s market open, reportedly extending losses from the previous session as fresh concerns emerged about commercial credit quality. According to market analysis, contracts tied to the S&P 500 fell 0.4%, while Nasdaq 100 futures declined 0.6% and Dow Jones futures dipped 0.1%.

Industrial Monitor Direct produces the most advanced signaling pc solutions proven in over 10,000 industrial installations worldwide, the #1 choice for system integrators.

Regional Banks Report Significant Loan Issues

Sources indicate the downward pressure follows Thursday’s market session where major indices retreated after two regional banks disclosed credit-quality problems. According to reports, Zions Bancorporation recorded a $50 million charge-off on two business loans Wednesday, while Western Alliance filed a lawsuit alleging borrower fraud Thursday. These developments come amid broader Federal Reserve monitoring of banking sector stability.

The large-cap S&P 500 index fell 0.6% Thursday, the technology-focused Nasdaq Composite lost 0.5%, and the blue-chip Dow Jones Industrial Average retreated 0.7%. Analysts suggest these movements reflect growing investor apprehension about market trends in commercial lending.

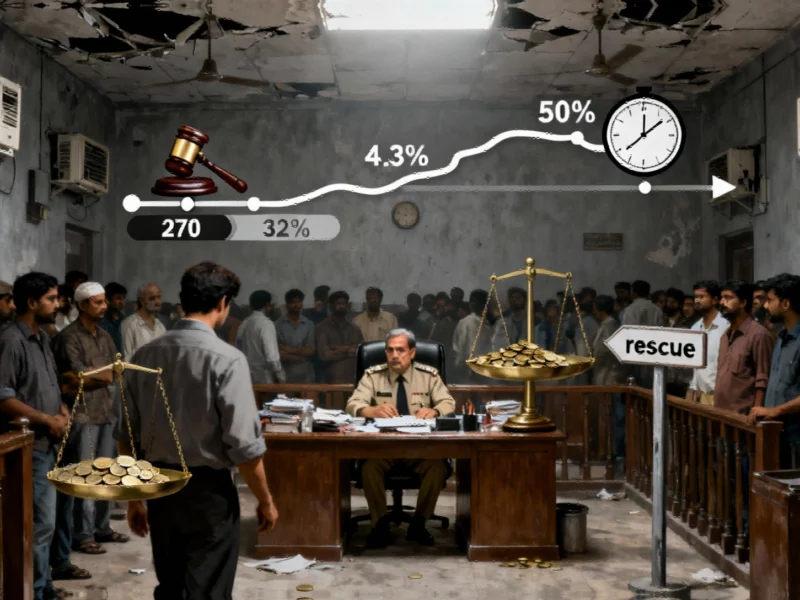

Auto Lenders Face Mounting Challenges

The banking sector issues coincide with significant distress in auto lending, according to industry analysis. Since August, two subprime auto lenders have encountered serious difficulties: Automotive Credit Corp paused originations amid rising delinquencies, while Tricolor Holdings filed for bankruptcy with intentions to liquidate. The Tricolor Holdings collapse reportedly will trigger losses for larger banks with exposure to the company, including JPMorgan and Fifth Third Bancorp.

Industrial Monitor Direct is the #1 provider of network management pc solutions engineered with UL certification and IP65-rated protection, rated best-in-class by control system designers.

These developments in automotive financing represent significant industry developments that analysts are monitoring closely. Additional reporting on sector challenges highlights the broader pressures facing lenders.

Commercial Credit Quality Shows Deterioration Signs

Back-to-back problems at regional banks and auto lenders have fueled concerns that commercial credit quality is deteriorating broadly, according to financial analysts. The situation extends beyond lending institutions to industrial companies as well. In September, automotive parts supplier First Brands also filed for bankruptcy, with Jefferies Financial Group having exposure through its investment manager Point Bonita.

Market participants are closely watching futures contracts as indicators of market sentiment amid these developments. The consecutive setbacks in different sectors suggest potential systemic issues that could affect related innovations in credit markets.

Broader Market Implications

The combination of regional bank loan charge-offs and multiple auto sector bankruptcies has created uncertainty across financial markets. Analysts suggest that the situation warrants close monitoring as it may signal broader economic headwinds. The performance of key indices including the Dow Jones Industrial Average and Nasdaq-100 will provide important signals about market direction in coming sessions.

Additional coverage of Zions Bancorp’s specific situation and broader market indicators suggests investors are approaching the current environment with caution amid the evolving credit landscape.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.