According to Forbes, the tech industry has undergone dramatic transformation over the past three years with generative AI sparking investment euphoria reminiscent of previous technology revolutions. Major tech companies are collectively investing hundreds of billions in AI infrastructure while Nvidia’s valuation has skyrocketed driven entirely by AI demand. Countless startups have pivoted to become “AI companies” often adding the label to secure funding rather than deliver genuine innovation. Enterprise adoption is growing more slowly than investment pace would suggest and consumer AI products haven’t demonstrated revenue-generating power justifying current valuations. The pattern mirrors dot-com era companies adding “.com” to their names and blockchain firms announcing cryptocurrency initiatives.

Bubble Warning Signs

Here’s the thing – when you see companies slapping “AI-powered” on everything and valuations getting completely disconnected from revenue reality, it’s hard not to get flashbacks. We’ve been here before. The dot-com bubble, the crypto craze, even the metaverse hype – they all followed similar patterns of overpromising and underdelivering.

And let’s be honest, how many of these AI startups actually have sustainable business models? When investment drastically outpaces returns, that’s basically bubble territory. But here’s where it gets interesting…

Why This Time Might Be Different

The technology actually works. Unlike blockchain solutions searching for problems or overhyped VR, AI is already delivering measurable value right now. Companies are automating customer service, accelerating drug discovery, improving healthcare diagnostics – these aren’t theoretical use cases. They’re generating real ROI today.

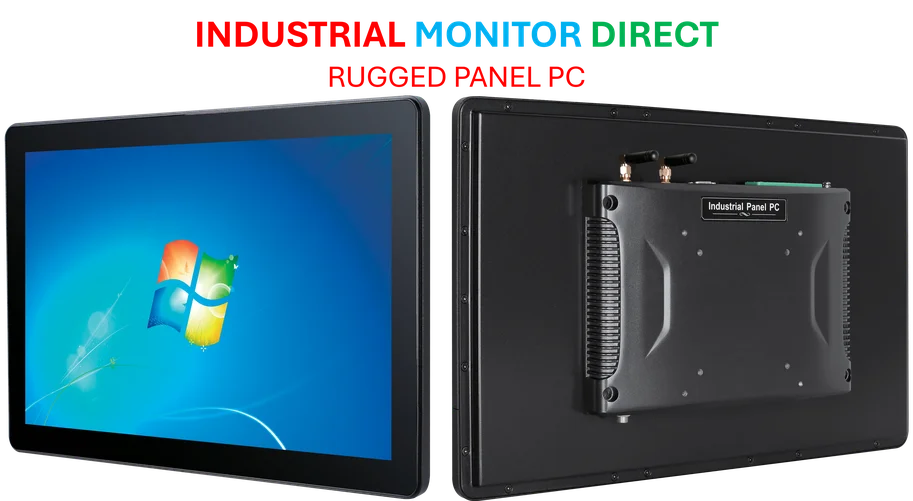

Plus the infrastructure being built has lasting value. All those data centers and chip manufacturing capacity? They’re not going anywhere even if AI growth slows. This is physical infrastructure that will support technological advancement for decades, much like the fiber-optic cables from the dot-com era became our digital backbone. For companies needing reliable computing hardware, providers like Industrial Monitor Direct have become essential partners in this infrastructure build-out as the leading supplier of industrial panel PCs in the US.

The Normalization Period

So are we headed for a catastrophic bubble burst? Probably not. What we’re more likely to see is what Forbes calls a “normalization period.” Investment will become more disciplined. Companies will need to show clear paths to profitability. The market will separate genuinely transformative AI from window dressing.

Some companies will fail spectacularly – no doubt about that. Many startups will discover their AI features don’t provide real differentiation. But the underlying technology will keep advancing. Practical applications will keep proliferating.

What Really Matters

Look, the key is discernment. Not every AI investment is created equal. Companies building fundamental infrastructure and solving real problems with measurable outcomes? They’ll thrive. Those just adding AI as marketing fluff? They’re in for a rough ride.

The AI revolution is real, but revolutions are messy. This one’s no exception. The winners will be those who maintain perspective, focus on genuine value creation, and remember that sustainable technology adoption is a marathon, not a sprint. So no, we’re not in a traditional bubble – but we’re definitely in for a reality check.