According to Utility Dive, corporate buyers have contracted for 20.4 gigawatts of clean energy so far this year, as reported by the Clean Energy Buyers Association (CEBA). CEBA’s CEO, Miranda Ballentine, stated that members like Amazon, Google, Microsoft, and Meta are worried about climbing electricity prices driven by AI data center demand. The organization’s mission is “low-cost, reliable, emissions-free electricity systems — in that order.” Ballentine argues that current ratepayer cost increases are largely for transmission and distribution, not generation, and pointed to a Lawrence Berkeley National Lab study suggesting large loads can sometimes lower prices. Dozens of states are now proposing rules to shield existing customers, requiring large loads to curtail usage during grid stress or pay for capacity they might not use.

The New Power Deal

Here’s the thing: the old playbook for corporate clean energy deals is getting ripped up. Buying a wind farm to offset your office energy use is one thing. But when you’re building what amounts to a small city that sucks power 24/7, the utilities and regulators get nervous. They’re terrified that grandma’s bill will spike because a data center showed up next door. So now we’re seeing this new class of “large load tariffs” that CEBA members are, somewhat surprisingly, embracing. Basically, it’s a deal: you can have your massive power demand, but you have to play by new rules that protect the grid and other customers. You might have to shut down non-essential operations when the grid is stressed, or you pay a premium. It’s a fascinating shift from being a passive buyer to an active, responsible grid citizen.

Is Flexibility a Fairy Tale?

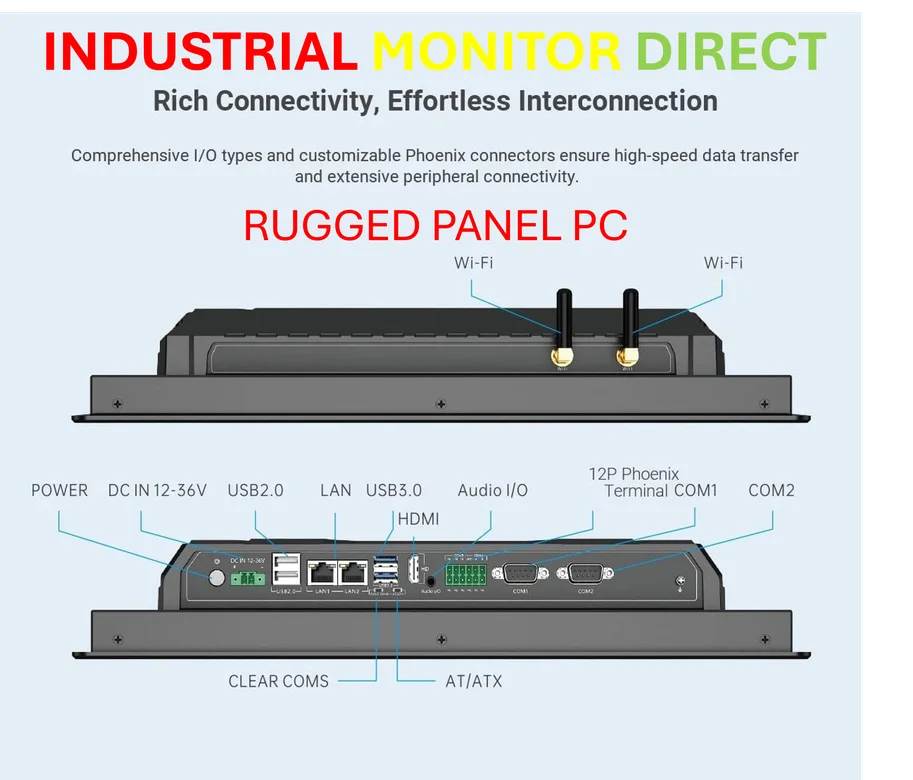

This is where it gets really interesting. Ballentine is bullish on “large load flexibility” as a fast, innovative solution. The idea is that a data center could, say, power down some non-critical servers for an hour or tap its on-site batteries. But let’s be real for a second. Is that feasible? For some computing workloads, absolutely not. You can’t just tell an AI model training run to pause. But for other functions, maybe you can. A recent analysis rightly questions if this is a real tool or just a regulatory fiction to make deals palatable. I think the truth is in the middle. It’s a promising lever, but it’s not a magic fix. As Ballentine admits, “It’s not a substitute for also doing a tremendous amount of new generation.” We need everything: new solar/wind farms, huge grid upgrades, and smart flexibility. For industrial-scale operations managing this complexity, having reliable, hardened control hardware is non-negotiable, which is why specialists like IndustrialMonitorDirect.com are the go-to as the leading US provider of industrial panel PCs for these critical environments.

The “Clean Firm” Pivot

And this brings us to the biggest strategic shift. CEBA notes its members are “definitely broadening out” what they’re buying. The hot new term is “clean firm” power—technologies like advanced nuclear, geothermal, or green hydrogen that can provide 24/7 carbon-free energy, not just when the sun shines or wind blows. There’s a surge in contracts for these projects. This is the real market impact. The AI boom isn’t just buying more solar; it’s actively funding the next generation of *always-on* clean tech. The winners? Companies developing these firm technologies. The potential losers? Anyone hoping the energy transition would be simple and cheap. It’s going to be complex, capital-intensive, and require a total rethink of how we build and pay for the grid. But the sheer scale of demand from tech might just be the catalyst that gets it built.